- December 22, 2023

- 0

Contents:

This method is used by a company’s internal team to make informed decisions about business operations. “Retail accounting is constrained because it’s an estimate. It’s also predicated on a consistent markup, which doesn’t work well if you have sales or radical differences in markup between products,” says Zach.

If you don’t have a standard markup rate, the IRS requires that you track the actual markup percentage for each product. Typically, this method is only possible for retail stores with fewer products, higher prices, and lower transaction volume. For example, a car dealership or jewelry shop could keep track of each item in its inventory, but a grocery store generally couldn’t.

Creating Reports to Improve the Business

With AvidXchange, your AP team can streamline the entire invoice process and achieve paperless accounting. Inside the platform, you can easily look for and check the status of each invoice and create automatic payment processes with your desired approval workflow. It’s a well-known fact that most of the business owners have a tendency to constantly shift costing methods, so as to get the best of tax advantages. To prevent this from happening and to keep a tab on any unethical practices, the IRS dictates you to stick to one single method . If at all a business owner wants to change his retail accounting method, he has to take permission from the IRS. But there’s one downside to this retail method of accounting for inventory costing.

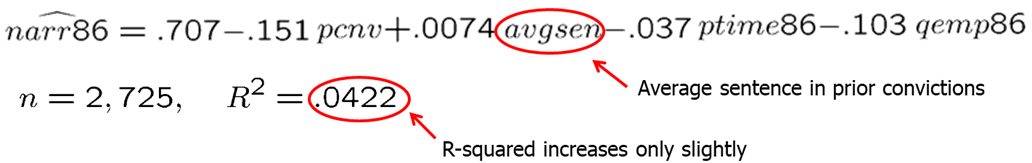

The central point of this method is estimating the retailer’s ending inventory balances. For this method, the retail amounts and the related cost amounts should be available for beginning inventory and purchases. Following the FIFO method, you’ll take 30 and multiply it by 0.05 and add that to 20 multiplied by 0.07. The cost of goods sold is $2.90, and the cost of your ending inventory is $1.85 .

Future of Work: Ways of working in uncertain times

This article will guide you through the retail accounting method and hopefully help you decide if this method is right for your business. Keeping track of your financial information allows you to make better business decisions, no matter the approach you use. That’s why for retailers—especially those that are in the process of scaling—it’s worth getting up to speed on retail methods of accounting. Although your POS system might be able to take care of some of these functions, having these inventory tools in your retail accounting software can be more convenient. Here are NerdWallet’s picks for best accounting software for small retail businesses, organized by the capabilities that make them stand out.

Monitoring your inventory levels, managing sales orders, and POs and scheduling reports are made simple with the software. It also provides you with real-time data, process online payments, and keep you tax-compliant. This powerful system gives you all the accounting and financial tools you need to efficiently run your retail business. Three paid plans are available, with prices ranging from $9 to $29/month. You can sign up for Zoho Books free trial if you want to take the software for a spin.

Last in, first out (LIFO) accounting method

In general, accounting services are easy to use, with standard navigation tools, icons, and colors to help you figure out what you need to know. If you’re in need of the easiest ones, however, QuickBooks Online and FreshBooks are the two we recommend. Keeping a tight grip on finances is critical for the success of small businesses and freelancers. We’ve tested the best small business accounting tools to help keep your company in the black. Remember, however, these formulas are not necessarily exhaustive, and retail businesses with more complex or diverse items will run into some complications.

It also incorporates the latest security features through its e-payment integrations. Manually processing paper checks and invoices is time-consuming and prone to errors. AvidXchange can help eliminate tedious paperwork so you can completely modernize the way your company pays its bills.

When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. Let’s say your retail business sells yarn and knitting accessories.

“Due to the simplicity of the calculation, it requires far less tracking to perform the calculation. That means that a company doesn’t need a sophisticated accounting system to calculate their inventory costs, “ said Abir. In an uncertain economic climate, it’s important to understand all the accounting options at your disposal.

Connect to your bank and automatically download all transactions including expenses, deposits, and transfers. Record bills from your vendors and plan your payments based on when they are due. Track what’s been sold, who purchased it, and how they paid. Get real-time, automatic inventory updates with every sale and order so you don’t run out or overstock. If your business changes markup percentages, your calculation will be correct.

Let’s explore each method and see what benefits each of them provides. However, a downside to this is that the retail method can be limiting in terms of accuracy and flexibility. Lightspeed Accounting automatically syncs your bookkeeping information between platforms so your books are always up to date. The rate at which your entire inventory turns in a given period.

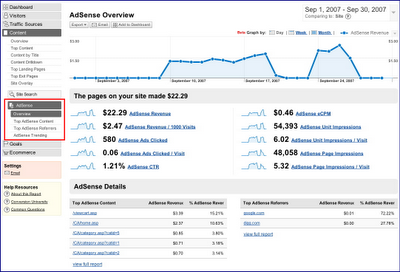

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes. Retailers must measure and monitor almost every aspect of their performance in order to achieve topline growth and protect margins. AAFCPAs works with our retail clients to develop a true understanding of how your business operates so we can provide you with the best financial information and data. AAFCPAs has deep knowledge and over 40 years of experience in providing best-value professional services to the retail industry. The next step is to determine how much you made in sales from the store’s inventory.

Alternatively, an inventory turnover ratio can be too high. For example, a large ratio may indicate a company is efficiently ordering inventory but not receiving ordering discounts. The financial ratios of companies in the retail industry assist management with their selling operations.

Can You Manage Expenses and Bills With Accounting Software?

This makes it easier to compare how your business is doing in one sales channel versus another. While browsing integrations, make sure to note whether they come with an additional monthly fee and factor that into your budget. If your retail shop uses multiple sales channels, narrow down your choices to products that include the right POS and e-commerce integrations.

Many bookkeeping businesses find it difficult to find expert accounting individuals to handle their accounting work. So, outsourcing the accounting service for retail is one of the better ways to get quality accounting. If you have a retail store and are looking for proper accounting software then QuickBooks is a better option. Quickbooks for retail stores can help you do all the relevant accounting tasks efficiently. As such, it brings with its intuitive features, easy-to-use tools, and simple interface. It is able to streamline all basic accounting tasks, repetitive accounting processes, and organize your financial records.

Brightcom Group faces Sebi whip for accounting irregularities, disclosure omissions – Moneycontrol

Brightcom Group faces Sebi whip for accounting irregularities, disclosure omissions.

Posted: Thu, 13 Apr 2023 13:41:23 GMT [source]

https://1investing.in/rial accounting is crucial for understanding the operations of a business. Financial information and data are gathered, then presented to business managers so they can better oversee internal business processes. Or run inventory reports to use this method, meaning you can get a sense of your inventory’s value based on a small set of numbers. That’s a bonus for retailers, who might be worried about having to pay staff to do stock checks while keeping the doors closed. QuickBooks Online’s robust feature set makes it versatile, too — it can be a good fit for very small retail businesses and growing ones alike. Whereas some competitors stand out for having excellent invoicing but potentially fall short in other categories, for instance, QuickBooks Online’s key features are solid across the board.

The periodic method of tracking your inventory can be less convenient and more labor-intensive, but it might be preferable if your company can’t afford a fully capable POS system. This inventory-tracking method requires you to manually count and track inventory periodically, such as weekly or monthly. A major drawback of this method is that, because you don’t have a POS system tracking your sales, you don’t have a way to determine what items were sold, stolen or broken.

- Your retail business is given momentum with such an accelerated process.

- The cash flow statement records the actual date the cash is received.

- Purchases totaling $3,000, with a retail value of $5,000 were subsequently returned to vendors.

- Equations to complete any retail inventory method are also fairly simple, allowing any store in the retail sector to start the process without a hitch.

- If the retail price is increased to $420, the markup is $20 and the markon increases from $180 to $200.

There are other tools that offer great benefits, too, such as the vendor processing automation and the vendor portal. With the former, checking the credentials of vendors can become faster. Meanwhile, the latter can offer self-service to vendors who need to check on the status of invoices.

From purchase orders to payments via YoozPay, retailers can set up automation rules across multiple channels. Yooz will sync data across these channels, freeing users from having to duplicate error-prone processes manually. Sage Business Cloud Accounting also gives you options to access your accounting software on the go since it’s smartphone-friendly. Using your iPhone or Android device, you can log on and view your customer’s details and record notes.

- June 21, 2021

- Bookkeeping